- Our services

- Optimisation of premiums

- End-of-year premium

End-of-year premium

We have been able to obtain a decision from the Office For Advance Tax Rulings of the FPS Economy whereby the conversion of the end-of-year premium from a "cash" form into warrants is possible without having to go through a cafetaria plan.

The FPS for Employment, Labour and Social Dialogue has given a favourable opinion on this conversion, provided that the renunciation of cash payment respects the hierarchy of sources of law. The analysis must therefore be carried out at the level of each joint committee.

By converting the 13th month into warrants, the employee and employer can obtain exemption from social security contributions (ONSS), and the employee's net pay can be increased by up to 45% via a partial or total retrocession of the employer's ONSS to the employee (warrants)

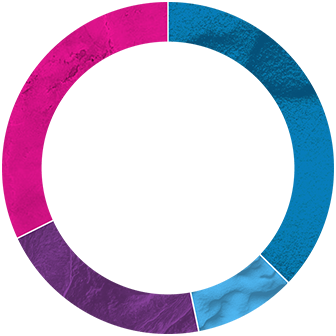

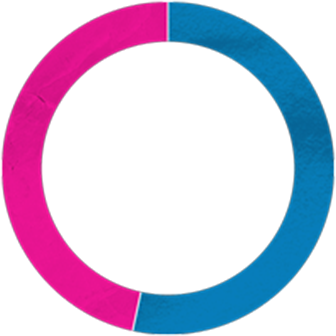

Classic end-of-year premium in cash

Short term warrants

- net

- Taxes

- NSSO Employee

- NSSO Employer